Key Performance Indicators Examples

CAC Payback Period

The CAC Payback Period is a metric used to measure the length of time it takes for a company to recoup the cost of acquiring a new customer. It is calculated by dividing the cost of acquiring a customer (CAC) by the average revenue per customer (ARPU) and is typically expressed in months.

The formula for calculating CAC Payback Period is:

CAC / ARPU = CAC Payback Period (months)

For example, if a company’s CAC is $100 and its ARPU is $50, the CAC Payback Period would be:

$100 / $50 = 2 months

This means that it takes the company 2 months to recoup the cost of acquiring a new customer through revenue generated by that customer. A shorter payback period is generally considered to be a good sign, as it means that a company is acquiring customers at a relatively low cost and that those customers are generating revenue quickly. A longer payback period may indicate that a company is spending too much money to acquire customers or that its customers have a low lifetime value.

It’s important to note that CAC Payback period is one of the key metric to measure the efficiency of customer acquisition strategy. Short payback period is desirable but it also depends on the industry and business model. Some businesses have longer sales cycles and therefore it might take them longer to recoup their CAC.

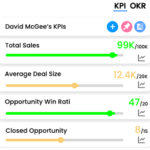

Measure what matters for your business with KPIs

Track business performance with real time key metrics against targets in one place without the need for multiple dashboards or reports