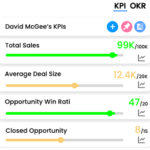

Key Performance Indicators Examples

Expenses

Expenses are the costs incurred by a business in the course of generating revenue. These costs can be classified into several categories, such as cost of goods sold (COGS), operating expenses, and non-operating expenses. The full formula for calculating total expenses would include all the costs that are incurred by the business in order to generate revenue.

The full formula for total expenses is:

Total Expenses = Cost of Goods Sold (COGS) + Operating Expenses + Depreciation + Amortization + Interest + Taxes

- Cost of Goods Sold (COGS) includes the direct costs associated with producing and selling the company’s products or services, such as raw materials, labor, and manufacturing overhead.

- Operating Expenses are the ongoing costs associated with running the business, such as rent, utilities, salaries, and other administrative expenses.

- Depreciation and Amortization are non-cash expenses used to allocate the cost of long-term assets over time.

- Interest is the cost of borrowing money, such as loans or bonds.

- Taxes are the amount of money a company must pay to the government in taxes.

It’s important to track expenses over time, compare it against industry benchmarks and historical data, to identify areas where the company’s operations can be improved. It’s also important to track expenses by different segments, such as by different teams, products, or locations, in order to identify where the problem is and take action to improve expenses.

Expenses are an important metric for companies, as they allow them to evaluate the effectiveness of their operations and make decisions about investments, finances, and growth. By keeping expenses under control, a company can improve its profitability and increase its net income.

Measure what matters for your business with KPIs

Track business performance with real time key metrics against targets in one place without the need for multiple dashboards or reports