Key Performance Indicators Examples

Net Profit Margin Or Net Margin

Net Profit Margin or Net Margin is a financial metric that measures the profitability of a company by expressing the net income as a percentage of revenue. It is used to measure the efficiency of a company’s operations and to identify areas where cost savings can be made.

The formula for Net Profit Margin is:

Net Profit Margin = (Net Income / Revenue) * 100%

It is calculated by dividing the net income (revenue minus all expenses) by the total revenue and then expressing the result as a percentage.

For example, if a company has revenue of $1,000,000 and net income of $200,000, the Net Profit Margin would be 20% ($200,000 / $1,000,000 = 0.2 x 100%).

It’s important to track the Net Profit Margin over time, compare it against industry benchmarks and historical data, to identify areas where the cost savings can be made. It’s also important to track the Net Profit Margin by different segments, such as by different teams, products, or customers, in order to identify where the problem is and take action to increase the Net Profit Margin.

Net Profit Margin is an important metric for companies as it allows them to evaluate the overall financial performance of the company, and make decisions about expenses, pricing, and investments.

It’s also important to keep in mind that the Net Profit Margin should be aligned with the business requirements and the needs of the end-users, a high Net Profit Margin can indicate a strong financial performance, but it can also mean that the company is not investing enough in its future growth or that the prices are too high for the end-users.

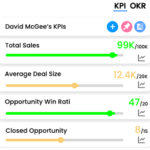

Measure what matters for your business with KPIs

Track business performance with real time key metrics against targets in one place without the need for multiple dashboards or reports