Key Performance Indicators Examples

Burn Rate

Burn rate is a metric used to measure the rate at which a company is spending its available cash. It is used to measure the company’s financial health and to identify areas where improvements can be made.

The formula for cash burn rate is:

Cash Burn Rate = (Beginning Cash Balance – Ending Cash Balance) / Time Period

It is important to note that this formula does not take into account any cash inflow during the period, such as revenue or new investments. It only considers the cash outflow, which is the difference between the beginning and ending cash balance.

For example, if a company has a beginning cash balance of $100,000, an ending cash balance of $50,000, and the time period is one month, the cash burn rate would be $50,000 or 50% ($100,000 – $50,000) / ($100,000/1) = $50,000 or 50%

It’s important to track the cash burn rate over time, compare it against industry benchmarks and historical data, to identify areas where the company’s operations can be improved. It’s also important to track the cash burn rate by different segments, such as by different teams, products, or locations, in order to identify where the problem is and take action to improve the cash burn rate.

Cash burn rate is an important metric for companies, as it allows them to evaluate the effectiveness of their operations and make decisions about investments, finances, and growth.

It’s also important to keep in mind that the cash burn rate should be aligned with the business requirements and the needs of the end-users, a low cash burn rate can indicate a strong financial position, but it can also mean that the company is not investing enough in growth opportunities or not investing in the future.

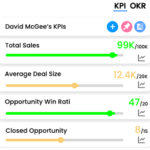

Measure what matters for your business with KPIs

Track business performance with real time key metrics against targets in one place without the need for multiple dashboards or reports