Key Performance Indicators Examples

Customer Lifetime Value

Customer Lifetime Value (CLV) is a prediction of the net profit attributed to the entire future relationship with a customer. CLV can be used to identify and target high-value customers, allocate marketing resources, and set sales targets. It is typically calculated by multiplying the average purchase value by the average number of purchases per year, and then multiplying that number by the average retention time (in years). Other factors, such as referral value and cost of sales, can also be included in the calculation.

The formula for calculating Customer Lifetime Value (CLV) is:

CLV = (Average Value of a Sale) x (Number of Repeat Transactions) x (Average Retention Time in Years)

This formula takes into account the total value that a customer will bring to a business over the entire duration of their relationship with the company. It can be broken down into three components:

- Average Value of a Sale: This is the average amount of money a customer spends on each transaction.

- Number of Repeat Transactions: This is the average number of times a customer will make a purchase over the course of their relationship with the company.

- Average Retention Time in Years: This is the average length of time a customer will remain a customer.

It’s important to note that this formula is a simplified version, there are many other factors like customer acquisition cost, referral rate, or discount rate can be included into the calculation for more accurate CLV.

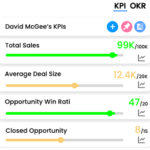

Measure what matters for your business with KPIs

Track business performance with real time key metrics against targets in one place without the need for multiple dashboards or reports