Key Performance Indicators Examples

Operating Expenses

Operating expenses refer to the costs a business incurs in order to maintain its day-to-day operations and generate revenue. These expenses are directly related to the production of goods and services, and include items such as cost of goods sold (COGS), selling expenses, and general and administrative expenses. Operating expenses are also known as operating costs, or simply operating expenses.

The formula for calculating operating expenses is:

Operating Expenses = Cost of goods sold (COGS) + Selling and marketing expenses + General and administrative expenses + Depreciation

- “Cost of goods sold” (COGS) is the direct costs associated with producing and selling a product, such as raw materials, labor, and manufacturing overhead.

- “Selling and marketing expenses” are the costs associated with promoting and selling a product or service, such as advertising, promotions, and commissions.

- “General and administrative expenses” are overhead costs that support the overall operation of the business, such as rent, utilities, office supplies, and insurance.

- “Depreciation” is the reduction in value of a company’s assets over time, such as equipment and buildings.

For example, if a company’s COGS is $100,000, selling and marketing expenses are $50,000, general and administrative expenses are $75,000, and depreciation is $25,000, the operating expenses would be $250,000.

It’s important to note that operating expenses are subtracted from revenue to calculate operating profit, also known as Earnings Before Interest and Taxes (EBIT). This metric is a key indicator of a company’s performance and efficiency. Additionally, it’s possible

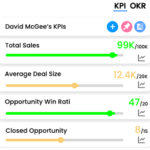

Measure what matters for your business with KPIs

Track business performance with real time key metrics against targets in one place without the need for multiple dashboards or reports