Key Performance Indicators Examples

Return on Equity (ROE)

Return on Equity (ROE) is a financial metric used to measure the profitability of a company in relation to the equity held by its shareholders. It is calculated by dividing the company’s net income by its total shareholders’ equity. The result is expressed as a percentage.

ROE is an indicator of how well a company is using the money invested by its shareholders to generate profits. A high ROE indicates that a company is generating a good return on the money invested by its shareholders, while a low ROE indicates that a company is not using the money invested by its shareholders as efficiently.

ROE can be used to compare the performance of different companies within the same industry, or to compare a company’s performance over time. It’s important to note that ROE can be affected by a company’s financial leverage (the amount of debt it uses to finance its operations) and by accounting methods used.

A high ROE can indicate that a company has a strong competitive advantage and is well managed, but a very high ROE may indicate that the company is taking on too much risk. A low ROE can indicate that a company is not well managed or that the industry is not favorable, but a very low ROE may indicate that the company is undervalued.

Here is an example of how to calculate Return on Equity (ROE):

Let’s say a company has a net income of $1,000,000 and total shareholders’ equity of $5,000,000.

To calculate the ROE, you would divide the net income ($1,000,000) by the total shareholders’ equity ($5,000,000)

ROE = $1,000,000 / $5,000,000 = 0.20 or 20%

This means that for every dollar of shareholders’ equity, the company is generating 20 cents of net income.

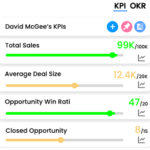

Measure what matters for your business with KPIs

Track business performance with real time key metrics against targets in one place without the need for multiple dashboards or reports