Key Performance Indicators Examples

Working Capital

Working capital is a measure of a company’s short-term financial health and liquidity. It represents the amount of a company’s current assets that are available to pay off its current liabilities, and it is used to measure a company’s ability to meet its short-term obligations.

The formula for working capital is:

Working Capital = Current Assets – Current Liabilities

It is calculated by subtracting a company’s current liabilities from its current assets. Current assets include cash, marketable securities, accounts receivable, and inventory. Current liabilities include accounts payable, short-term debt, and taxes.

For example, if a company has current assets of $500,000 and current liabilities of $300,000, the working capital would be $200,000 ($500,000 – $300,000).

A positive working capital means that a company has enough liquid assets to meet its short-term obligations, while a negative working capital means that a company would have trouble meeting its short-term obligations if they came due immediately.

It’s important to track the working capital over time, compare it against industry benchmarks and historical data, to identify areas where the company’s operations can be improved. It’s also important to track the working capital by different segments, such as by different teams, products, or locations, in order to identify where the problem is and take action to improve the working capital.

Working capital is an important metric for companies, as it allows them to evaluate the effectiveness of their operations and make decisions about investments, finances, and growth.

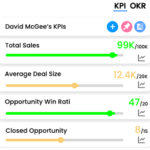

Measure what matters for your business with KPIs

Track business performance with real time key metrics against targets in one place without the need for multiple dashboards or reports